We use cookies on our website.

Some of them are necessary for the functioning of the site, but you can decide about others. View more

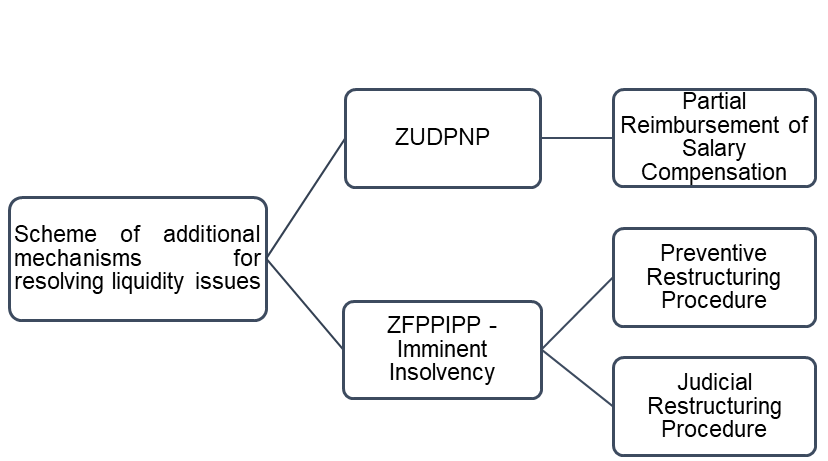

Recently, we have been continuously witnessing forecasts of a cooling of economic activity in Slovenia, which, among other things, increases the risk of serious liquidity problems in companies. With this contribution, we present to the management bodies of business entities the legal mechanisms introduced in 2025 to mitigate these difficulties. They derive from the Act on the Enforcement of Partial Reimbursement of Salary Compensation for Reduced Working Hours (ZUDPNP) and the Amendment to the Financial Operations, Insolvency Proceedings and Compulsory Dissolution Act (Amendment ZFPPIPP-H).

1. ZUDPNP – Partial Reimbursement of Salary Compensation

The primary aim of ZUDPNP is the preservation of jobs in situations of temporary inability to provide work due to temporary circumstances (e.g., economic crisis in the automotive sector), natural or other disasters, or crisis conditions. Companies thus have the option of ordering work on a reduced working time basis, while partially assigning employees to temporary waiting for work from 5 to 20 hours per week. In return, ZUDPNP offers partial reimbursement of salary compensation, thereby alleviating liquidity challenges for affected companies.

The right to partial reimbursement of salary compensation may be claimed by an employer who employs workers on the basis of a full-time employment contract and who, in their own assessment, cannot provide at least 90% of work to at least 30% of their employees on a monthly basis. The employer must nevertheless ensure work for at least half of the full working time.

Of particular importance for companies will be the possibility of reimbursement in the event of temporary circumstances (e.g., an economic crisis). This option is conditional on a prior government decision, which defines the sectors where circumstances have arisen that employers could not reasonably influence or prevent, and whose temporary negative impact on business volume has resulted in the temporary inability to provide sufficient work to their employees. At the time of preparing this article, no such government decision had yet been adopted according to publicly available information.

The amount of partial reimbursement of salary compensation is limited to 60% of the paid salary compensation without employer contributions (gross I). In any case, reimbursement may not exceed 50% of the most recently known average annual salary, calculated on a monthly basis. The eligibility period is further limited to 6 months in the case of temporary circumstances, and 6 months within 24 months from the first order in the case of a natural or other disaster.

During the period of temporary waiting, employees will have to participate in training and education. Companies that receive reimbursements will also be subject to certain restrictions on further operations to ensure fair use of funds, such as restrictions on dividend payments.

2. Amendment ZFPPIPP-H – Imminent Insolvency

When liquidity problems escalate into more serious financial issues, a company may enter into a situation of so-called imminent insolvency. This is defined as a situation where it is probable that the company will become insolvent within one year. Such regulation underscores the importance of timely action and the provision of appropriate instruments, which can be crucial for the survival of a financially weakened entity.

To facilitate the recognition of imminent insolvency, the Ministry of the Economy, Tourism, and Sport has developed an application for signalling imminent insolvency. The application, in the form of an Excel spreadsheet for management bodies, is not mandatory, but it can serve as a first step in timely recognizing imminent insolvency and taking appropriate measures. The application is available at the following link .

The law provides for two procedures in the event of imminent insolvency:

The first is a judicial procedure aimed at restructuring both financial and business obligations. The second is a non-judicial procedure intended solely for restructuring financial obligations, which already existed before Amendment ZFPPIPP-H. Although the amendment was adopted back in 2023, the provisions regarding judicial restructuring to eliminate imminent insolvency only began to apply on 1 January 2025.

a) Judicial Restructuring Procedure to Eliminate Imminent Insolvency

This procedure is conducted with the aim of enabling financial restructuring based on a confirmed compulsory settlement, necessary to eliminate the causes that would otherwise lead the company to insolvency.

The judicial restructuring procedure to eliminate imminent insolvency is similar to the compulsory settlement procedure; therefore, the rules of compulsory settlement (with certain adjustments) apply mutatis mutandis. Among other things, the principle of absolute priority under Article 136 ZFPPIPP applies, as does the possibility of restructuring through debt-to-equity conversion. The essential difference lies in the timing of the proceedings—the judicial restructuring procedure is conducted before actual insolvency occurs.

Other key differences include:

only the company (debtor) and personally liable shareholder may propose the initiation of the judicial restructuring procedure; creditors have no such right;

the financial operations report does not include liquidation value of assets but rather an asset valuation in accordance with international valuation standards under the assumption of fair sale, or a valuation of the company’s market value as a going concern;

a confirmed compulsory settlement does not affect employee claims arising from employment relationships;

a creditor may object on grounds that the debtor is not yet imminently insolvent, or is already insolvent;

the court decides on a creditor’s petition for the initiation of bankruptcy proceedings regardless of the debtor’s petition for judicial restructuring due to imminent insolvency;

the petition for judicial restructuring does not contain a subsidiary request for bankruptcy if the petition is dismissed, rejected, or the procedure is terminated. Likewise, bankruptcy is not initiated if the required majority for adopting compulsory settlement is not reached. Nevertheless, the court initiates bankruptcy proceedings if an objection on the grounds of insolvency is upheld, or if the financial report contains false or incorrect data, or if the company refuses creditor access to documentation;

neither the initiation of the procedure nor the confirmed compulsory settlement in judicial restructuring affects financial collateral under the Financial Collateral Act and claims secured thereby.

At the start of the procedure, enforcement and security proceedings are suspended and prohibited, for a period of 4 months. This period may be extended under certain conditions, but to a maximum of 12 months. Despite the suspension, a creditor may obtain court consent for out-of-court enforcement of the right to separate satisfaction. The suspension does not apply to claims for employee salaries.

b) Preventive Restructuring Procedure

As already mentioned, the preventive restructuring procedure was known before Amendment ZFPPIPP-H, resulting in the conclusion of a Master Restructuring Agreement. However, prior to the amendment, this procedure was merely an option for management, not an obligation. Now, management is explicitly required, in cases of imminent insolvency, to adopt appropriate financial restructuring measures, which may include the initiation of preventive restructuring or judicial restructuring due to imminent insolvency.

3. Conclusion

With the introduction of ZUDPNP and the full implementation of Amendment ZFPPIPP-H, the legislator in 2025 has provided management bodies with additional mechanisms for timely response to liquidity difficulties. While ZUDPNP short-term alleviates the consequences of a temporary reduction in business volume, preserves jobs, and improves liquidity for affected companies, Amendment ZFPPIPP-H introduces an additional procedure for imminent insolvency and imposes obligations on management even before actual insolvency occurs. The solutions presented can significantly contribute to the long-term improvement of the financial position and survival of affected companies.